Situation

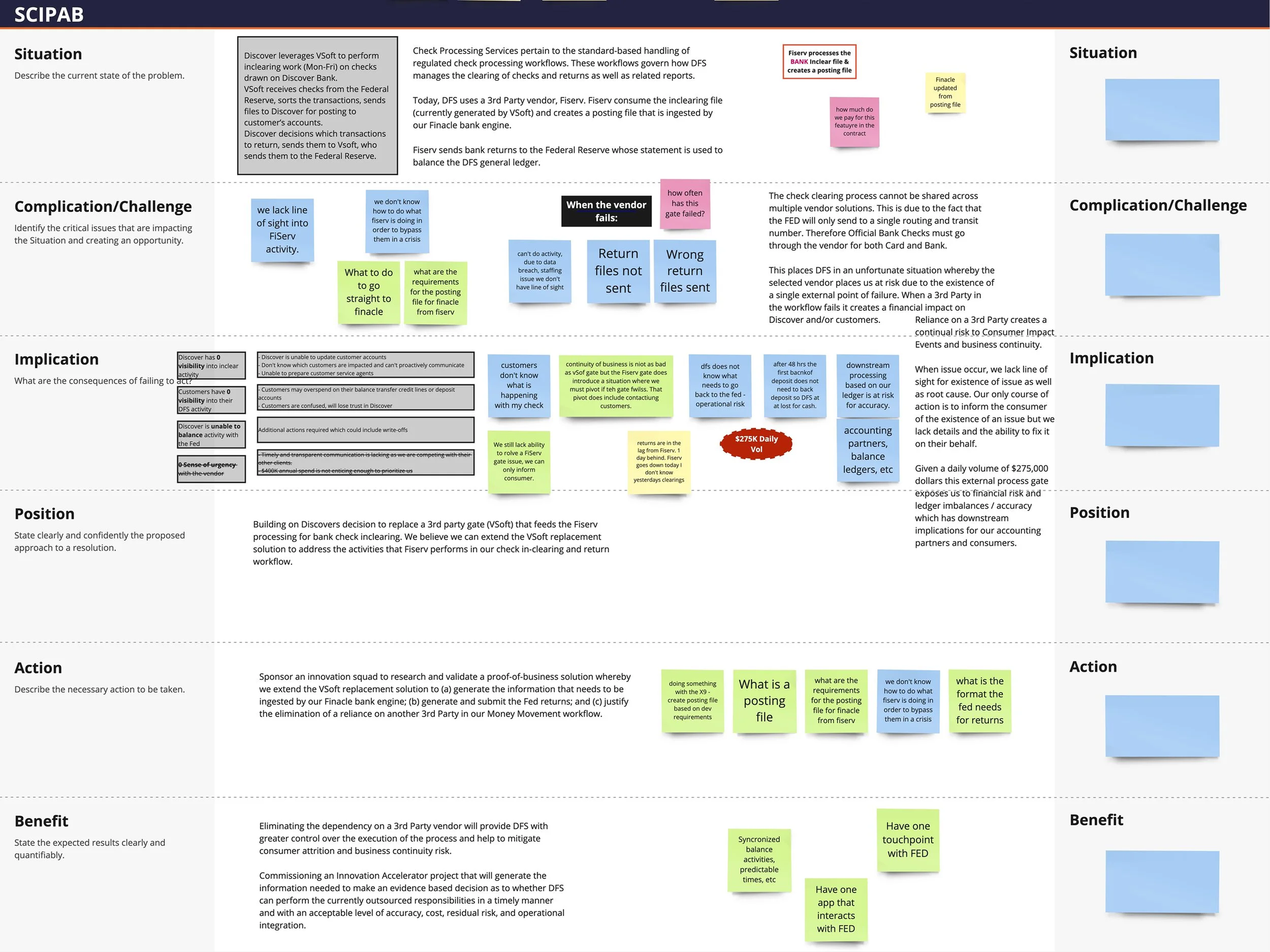

Discover’s check processing team was facing significant security and operational challenges with their check and mobile processing systems. Existing Software-as-a-Service (SaaS) solutions required sending personally identifiable information (PII) and payment card industry (PCI) data to external vendors, creating security risks and compliance concerns. The organization needed both check processing (from X9 files) and mobile credit card scanning capabilities, but no single vendor supported both use cases. Additionally, signature overlap accounted for 80-90% of OCR processing errors, while existing solutions showed limited accuracy with small sample sizes and high licensing costs.

Task

ROLE: Designer, Facilitator, Project Manager

RESPONSIBILITIES: Problem Ideation & Clarification and Design

COLLABORATORS: Check Processing Product teams, Application Development and Architecture

I served as designer, facilitator, and project manager for developing an in-house OCR solution. Working alongside engineers from our Research & Development team (known as the Innovation Accelerator at the time of this project) and sponsors from Processing Services, E-Business, Application Development, and Application Architecture, my challenge was to help identify how we can build technology in-house that could process financial documents while eliminate vendor dependencies, reduce costs, and maintain security compliance for PCI/PII data.

The standing questions were:

How do we minimize the manual work that is error prone without relying on a vendor, which can affect business continuity

Could we create this technology and manage it in-house?

Could this be reusable internally and beyond?

Action

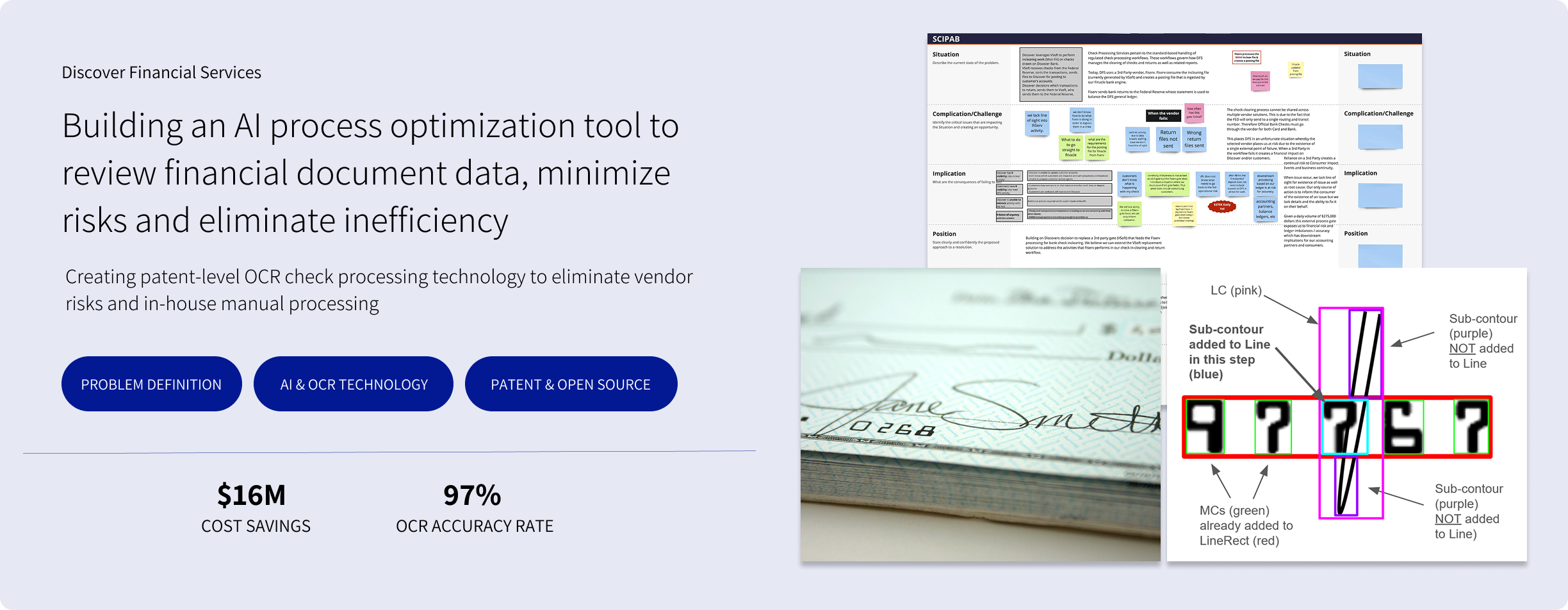

SCIPAB Methodology Implementation: Led problem definition using the SCIPAB framework (Situation, Complication, Implication, Position, Action, Benefit) to structure the innovation approach and establish the build vs. buy comparison framework. This helped clarify the financial and compliance costs of continuing down and a vendor focus path and that it was not a sustainable solution.

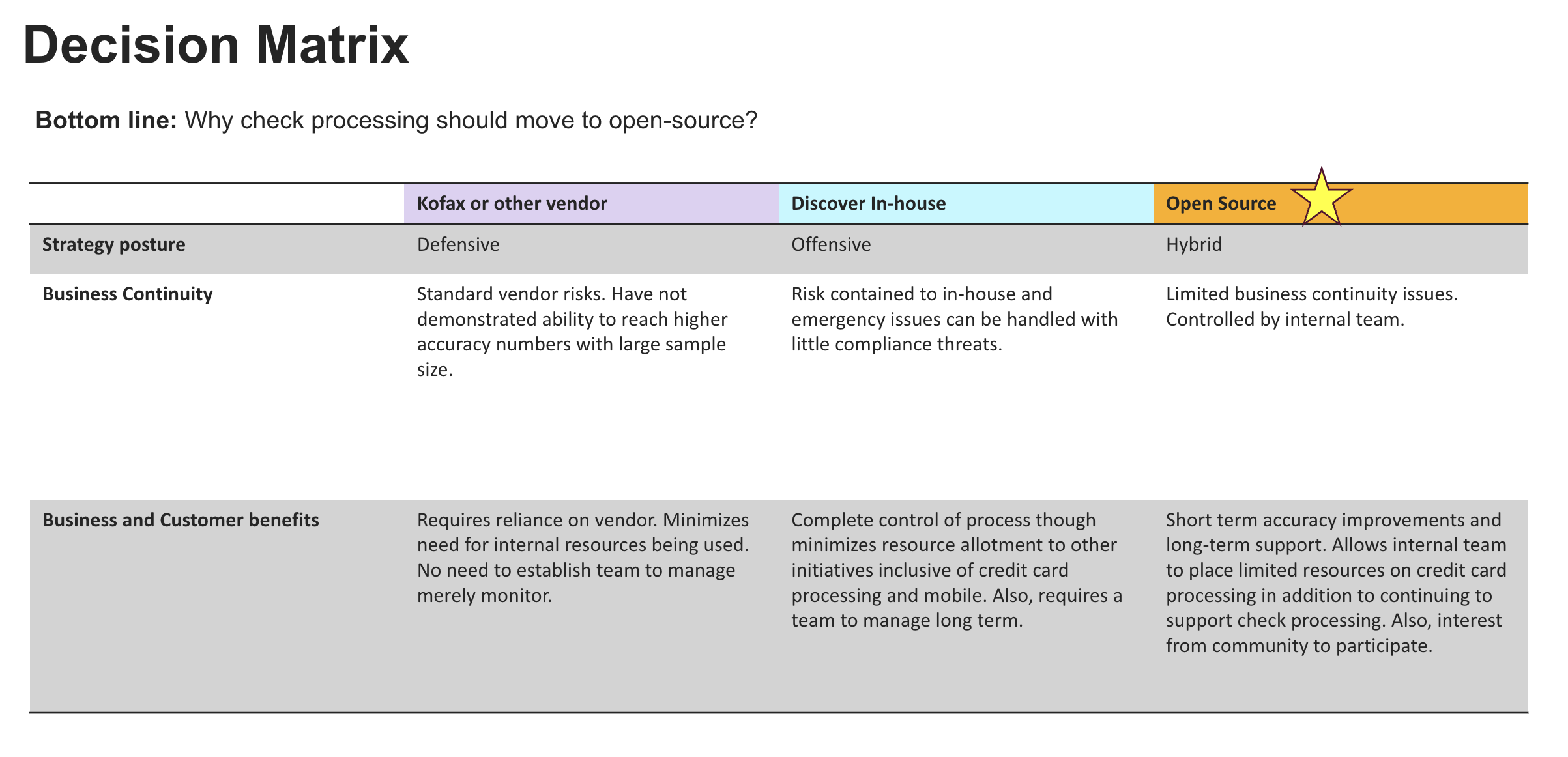

Strategic Risk Assessment & Solution Architecture: Led comprehensive analysis of vendor dependencies and security vulnerabilities, developing business case for in-house solution that eliminated $16M in annual licensing costs while maintaining superior accuracy standards and regulatory compliance. Also, created a research based decision matrix to compare beyond just building the solution in-house to move to open-source.

Comparing decision approaches based on business continuity and benefits

Comprehensive Solution Development: Led project coordination for reusable OCR SDK development including OCR CLI, Core OCR with Tesseract.js, Check Interface with OpenCV.js, and RESTful Microservice components supporting both DFS Check Processing and Mobile applications.

Innovation Patent Development: Developed patent-worthy innovation for partnering with our engineers to identify and detect signature overlap (Over 80 to 90% of errors are due to signature overlap) using methods for locating MICR* lines when curvature and signature overlap occur, addressing the primary source of processing errors.

*A magnetic ink character recognition (MICR) line is the unique series of characters printed on a check that indicates the bank routing number, account number, and check number, enabling automated processing and preventing fraud.

Example of signature overlap

Example of marks crossing over routing and account number leading to processing errors

Results

The solution eliminated security risks by keeping PCI/PII data on-device rather than transmitting to external vendors, while delivering superior accuracy through larger-scale testing. In this we were able to minimize business risk with an in-house service. The methodology and SDK were designed for open-source collaboration to enable continued accuracy improvements, and the innovation was later featured in a FINOS Foundation spotlight as an example of cutting-edge financial document processing technology. Highlights include:

$16M in annual savings through vendor elimination and licensing cost reduction

97% accuracy achieved with 20,000+ check sample validation (compared to vendor 95% accuracy with small sample sizes)

Reusable SDK developed for both check and mobile processing applications, and patent filed for signature overlap detection innovation.

Learn more about the technology here in our press release.